Tobacco Products Market Size, Share & Key Emerging Trends Forecast 2025–2032

Market Overview

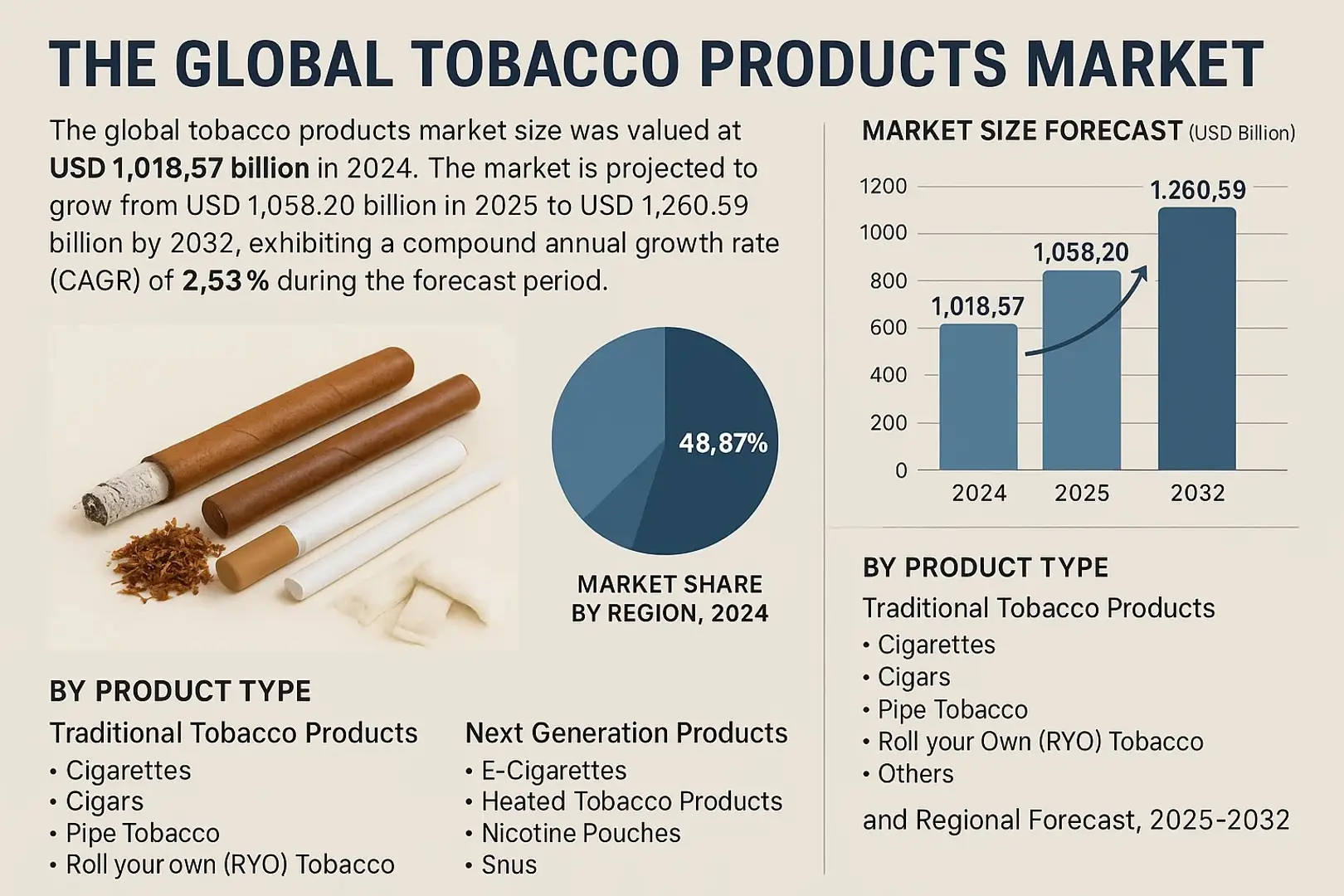

According to Fortune Business Insights, the global tobacco products market size was valued at USD 1,018.57 billion in 2024 and is projected to reach USD 1,260.59 billion by 2032, growing at a CAGR of 2.53% from 2025 to 2032. This market growth is fueled by the rising demand for next-generation products (NGPs) such as e-cigarettes, heated tobacco, and nicotine pouches, alongside strong consumption of traditional cigarettes and cigars across key markets.

Asia Pacific dominated the market with a 48.87% market share in 2024, led by China, India, and Southeast Asia, where cigarette consumption and flavored nicotine product sales remain strong.

Download Free Sample Report Now to gain insights into market forecasts, segmentation, and competitor strategies. https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/tobacco-products-market-112987

Key Market Insights

2024 Market Size: USD 1,018.57 billion

2025 Market Size: USD 1,058.20 billion

2032 Forecast: USD 1,260.59 billion

CAGR (2025–2032): 2.53%

Leading Region: Asia Pacific (48.87% share in 2024)

Fastest-Growing Segment: Next-Generation Products (NGPs)

Key Market Trends

Asia Pacific witnessed tobacco products market growth from USD 475.84 billion in 2023 to USD 497.81 billion in 2024.

Growing Popularity of Slim & Flavored E-Cigarettes in China and Southeast Asia.

Social Media Influence – Brands like Philip Morris’ ZYN leverage TikTok, reaching over 700M+ followers.

Innovation in Heat-Not-Burn Devices – PMI’s IQOS BONDS and JT’s with 2 redefine smoke-free consumption.

Market Dynamics

Market Drivers

Rising Disposable Income Among Women – Growing female smoking rates, especially in Europe and Asia, are expanding the consumer base.

Increased Usage of Nicotine Products Among Youth – Social media marketing and flavored offerings are driving high adoption rates.

Market Restraints

Regulatory Bans on E-Cigarettes in countries like India, Brazil, and Thailand hinder growth opportunities.

Market Opportunities

Booming Demand for Flavored Nicotine Products – Innovative flavors such as mint, chocolate, fruit, and herbal blends are gaining traction.

Expansion of Next-Generation Products (NGPs) – Heated tobacco, nicotine pouches, and vapor devices are accelerating global adoption.

Market Segmentation

By Product Type

Traditional Tobacco Products

Cigarettes (largest segment)

Cigars

Pipe Tobacco

Roll-Your-Own (RYO) Tobacco

Raw Tobacco & Chewing Leaves

Next-Generation Products (NGPs)

E-Cigarettes

Heated Tobacco Products (HTPs)

Nicotine Pouches (ZYN, On Plus, etc.)

Snus

Herbal Cigarettes, Hookah, Dokha, and Dissolvable Strips

Key Trend:

Heated Tobacco Products (HTPs) are expected to witness the fastest growth from 2025–2032.

Nicotine Pouches are the second fastest-growing category, fueled by digital and influencer marketing campaigns.

Regional Outlook

Asia Pacific

Market Size (2024): USD 497.81 billion

Key Drivers: High cigarette consumption in China (291M+ smokers), flavored e-cigarettes in Southeast Asia, and premium betel leaf shops in India.

North America

Strong adoption of smoke-free products such as e-cigarettes and nicotine pouches.

U.S. leads the region, with rising cigar and pipe tobacco consumption among women.

Europe

Significant demand for nicotine pouches and e-cigarettes in the U.K., Sweden, and Switzerland.

Strict regulations fuel innovation in smoke-free alternatives.

South America & Middle East

Brazil and Argentina: Regulatory restrictions on smoking increase heat-not-burn product demand.

Middle East: High cigarette usage but growing shift toward herbal tobaccos and dokha.

To get to know more about this market: https://www.fortunebusinessinsights.com/tobacco-products-market-112987

Competitive Landscape

The global tobacco products market is highly fragmented, with the top 5 players holding only 13.60% share (2024). Companies are investing heavily in R&D and product innovation to capture the evolving consumer base.

Major Players:

Philip Morris Products S.A. (U.S.)

Altria Group, Inc. (U.S.)

British American Tobacco plc. (U.K.)

Japan Tobacco Inc. (Japan)

Imperial Brands plc. (U.K.)

ITC Limited (India)

PT Hanjaya Mandala Sampoerna Tbk (Indonesia)

PT Perusahaan Rokok Tjap Gudang Garam Tbk (Indonesia)

KT&G Corporation (South Korea)

China National Tobacco Corporation (China)

📌 Example: In March 2023, Altria Group launched Swic (heated tobacco device) and On Plus (nicotine pouch) to expand its smoke-free portfolio.

Key Industry Developments

December 2024- Philip Morris International (PMI) announced the development of affordable next-generation products (NGPs) aimed at the African market. This initiative is driven by the recognition that the smoke-free market in Africa is still in its early stages, and there is a significant demand for cost-effective alternatives among price-sensitive consumers.

September 2024- British American Tobacco (BAT) launched a significant global initiative aimed at creating a “Smokeless World.” This initiative, unveiled during the company’s first Transformation Forum in London, features the Omni™ platform, which serves as an evidence-based resource to facilitate discussions around Tobacco Harm Reduction (THR).

The global tobacco products market is undergoing a significant transformation, driven by innovation, flavored products, and shifting consumer behaviors. While traditional tobacco remains dominant, the fastest growth lies in reduced-risk and next-generation products (NGPs).

Related Posts

© 2025 Invastor. All Rights Reserved

User Comments