Lithium Metal Market Companies, Restraints, Share & Forecast 2032

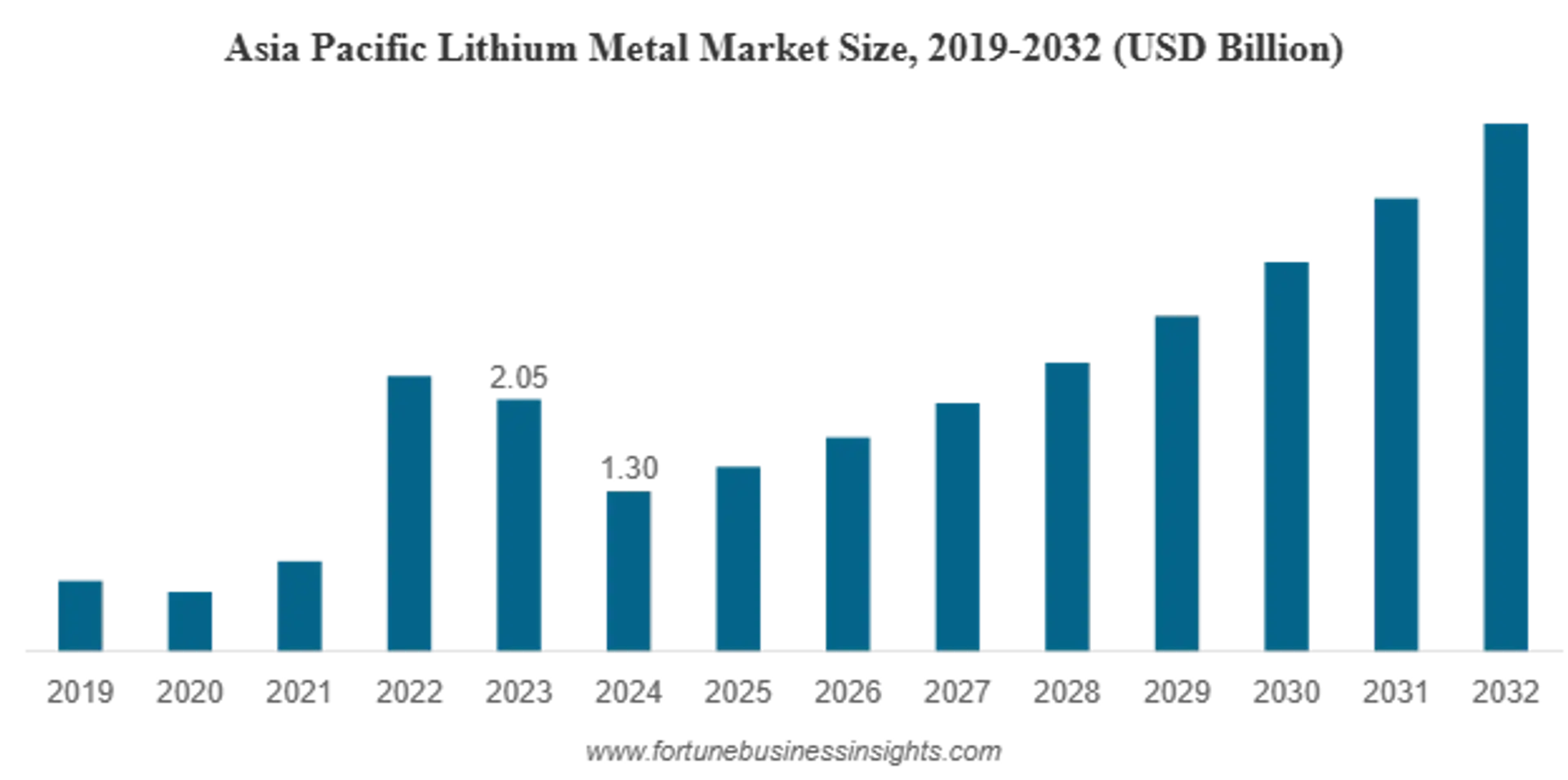

In 2024, the global lithium metal market was valued at USD 2.21 billion and is expected to grow to USD 2.55 billion in 2025, reaching USD 7.25 billion by 2032, with a projected CAGR of 16.0% during the forecast period. Asia Pacific led the market in 2024, holding a 58.82% share.

The global lithium metal market is experiencing strong growth as industries increasingly rely on advanced battery technologies to power next-generation applications. Lithium metal, known for its lightweight and high-energy characteristics, plays a vital role in energy storage systems, particularly in the development of solid-state batteries and high-energy-density applications. With the global shift towards electric mobility, renewable energy storage, and enhanced consumer electronics, lithium metal is becoming a strategic material with growing commercial value.

Market Size and Growth Forecast

In recent years, the lithium metal market has witnessed accelerated development, driven by the rising demand for improved battery performance. The market is projected to grow significantly in the coming years, supported by ongoing innovations in solid-state battery technology, increasing investments in lithium production, and expanding end-use applications. This growth is especially prominent in sectors such as electric vehicles (EVs), grid storage, aerospace, and portable electronics.

List Of Key Lithium Metal Companies Profiled

- Ganfeng Lithium Group Co. Ltd. (China)

- Techtone Inorganic Co., Ltd. (China)

- Chengxin Lithium Group Co., Ltd. (China)

- Rio Tinto (U.K.)

- CNNC Jianzhong Nuclear Fuel Co., Ltd. (China)

- Albemarle Corporation (U.S.)

- Li-Metal Corp. (Canada)

- Tianqi Lithium Inc. (China)

- ATT Advanced Elemental Materials Co., Ltd. (U.S.)

- Merck KGaA (Germany)

Read More : https://www.fortunebusinessinsights.com/lithium-metal-market-113413

Key Drivers Boosting Market Growth

- Surging Demand for Solid-State Batteries

One of the major factors fueling the lithium metal market is the growing interest in solid-state batteries. These batteries use lithium metal as the anode instead of graphite, delivering superior energy density, faster charging capabilities, and enhanced safety. Solid-state battery developers are actively exploring lithium metal to create batteries that can support the energy needs of future EVs and electronics. With companies and research institutions worldwide investing in commercializing these batteries, the demand for lithium metal is set to increase substantially over the forecast period.

- Electrification of the Automotive Industry

The global transition toward electric vehicles is another primary driver of the lithium metal market. Automakers are rapidly shifting to electrification in response to stricter emissions regulations and rising consumer preference for clean transportation. Lithium metal-based batteries are being explored as a way to extend EV range and improve battery performance, helping address key limitations of traditional lithium-ion technology. As EV production scales up, demand for advanced battery materials such as lithium metal is expected to rise steadily.

- Government Policies and Energy Transition Goals

Governments across the globe are supporting clean energy transitions through financial incentives, regulatory frameworks, and infrastructure development. National strategies to reduce carbon emissions and dependence on fossil fuels have led to greater investments in battery manufacturing and lithium resource development. These policies have created a favorable environment for the lithium metal market by promoting the adoption of next-generation energy storage technologies and supporting domestic lithium value chains.

- Expansion in Consumer Electronics and Wearable Devices

Lithium metal is also gaining traction in the consumer electronics industry. Devices such as smartphones, laptops, drones, and wearables require compact, lightweight batteries with higher energy capacities. Lithium metal’s potential to enhance energy density makes it an attractive option for future electronics. The continuous miniaturization of devices and consumer demand for long-lasting power sources are contributing to a broader use of lithium metal in these applications.

Regional Insights

- Asia Pacific leads the global lithium metal market, with China playing a dominant role in both production and consumption. China’s extensive battery manufacturing capacity, large EV market, and government-backed initiatives for lithium resource development contribute to its leadership. Other countries such as South Korea and Japan are also heavily investing in battery R&D and lithium-based technologies.

- North America is another key region, benefiting from growing EV adoption, increased focus on energy storage systems, and rising investment in lithium supply chains. The U.S. is actively expanding its domestic production capabilities to reduce reliance on imports and secure critical materials for clean energy industries.

- Europe is witnessing strong momentum due to its Green Deal initiatives, electrification goals, and efforts to establish a competitive battery ecosystem. Countries like Germany and France are focusing on lithium refining, recycling, and battery innovation to build a sustainable supply chain for lithium-based materials, including lithium metal.

Key Industry Developments

- March 2025: Rio Tinto completed its USD 6.7 billion acquisition of Arcadium Lithium, positioning itself as a global leader in the supply of energy transition materials and significantly expanding its lithium portfolio to support the growing demand for clean energy solutions.

- August 2024: Arcadium Lithium acquired Li-Metal Corp.’s lithium metal business for USD 11 million in an all-cash deal. This acquisition included intellectual property, patents, and a pilot production facility in Ontario, Canada. This acquisition aimed to enhance Arcadium’s capabilities in producing lithium metal from various grades of lithium carbonate feedstock.

Challenges to Market Growth

Despite the strong growth outlook, the lithium metal market faces several challenges. One of the primary concerns is the high reactivity of lithium metal, which makes handling and storage difficult. Safety concerns and technical limitations in manufacturing solid-state batteries at scale have slowed down commercial adoption.

In addition, the high cost of lithium metal production compared to other battery materials remains a hurdle. The limited availability of commercial-grade lithium metal and concerns over resource sustainability have prompted efforts to enhance extraction techniques, explore recycling options, and improve overall supply chain efficiency.

Future Outlook

Looking ahead, the lithium metal market is expected to remain on a growth trajectory, driven by continued advancements in battery technologies and increasing demand from automotive, consumer electronics, and energy sectors. As solid-state batteries inch closer to commercialization and EV manufacturers seek longer-lasting, higher-performing batteries, lithium metal will play a pivotal role in shaping the next generation of energy storage solutions.

Innovations in production technology, investments in refining infrastructure, and collaborations across industries will be essential to meet future demand and address the challenges facing the market. With rising awareness around clean energy and sustainability, lithium metal is poised to become a cornerstone material in the global energy transition.

Related Posts

© 2025 Invastor. All Rights Reserved

User Comments