How To Get Insurance To Pay For Car Repair?

Understanding the complexities involved in getting insurance to cover car repairs can feel challenging, but with the right approach, it becomes manageable. Understanding your policy and knowing the right steps can save you both time and money. It’s crucial to stay informed about what is covered and how to maximize your benefits.

By following the correct procedures, you can ensure a smoother experience. Whether it’s a minor repair or significant damage, the right approach can make a big difference. This guide will outline effective strategies to achieve this.

Reviewing Your Insurance Policy Coverage

Understanding the details of your insurance policy is essential when seeking coverage for repairs. Policies vary significantly, with some covering only specific types of damage. Carefully review the terms, conditions, and exclusions listed in your agreement to avoid surprises.

Many drivers overlook small details that could lead to claim denial. Ensure you’re aware of deductibles and whether repairs need to be done at approved facilities. If you’re searching for affordable repair solutions, the Mobile Mechanics las vegas can provide a valuable option to explore alongside your policy’s stipulations.

Identifying the Type of Damage and Its Cause

Insurance claims are typically based on the nature of the damage. Understanding whether the issue stems from an accident, weather, or wear and tear is essential. Insurers usually classify damage to determine whether it’s eligible for coverage.

Pinpointing the exact source of the damage helps facilitate a smoother claims experience with your insurer. Insurers often require evidence, such as photos or detailed descriptions. Being specific about the problem will help reduce complications and increase your chances of approval.

Filing a Claim with Your Insurance Company

Once you’ve reviewed your policy and identified the damage, it’s time to file a claim. Contact your insurer promptly and provide all necessary details. Include a description of the damage and any evidence you’ve gathered to support your case.

Insurers typically guide you through the next steps. Keep communication open and follow their instructions closely. Meeting deadlines and ensuring all paperwork is complete can prevent unnecessary delays in processing your claim.

Working with Approved Repair Shops

Many insurance companies have a list of approved repair shops. Using one of these facilities can simplify the process. Approved providers often have agreements with insurers to handle claims efficiently, making it easier for you.

If you prefer another shop, confirm with your insurer that it’s acceptable. Not all repairs outside their network may be covered. Always prioritise quality and ensure the repair shop is reliable before proceeding.

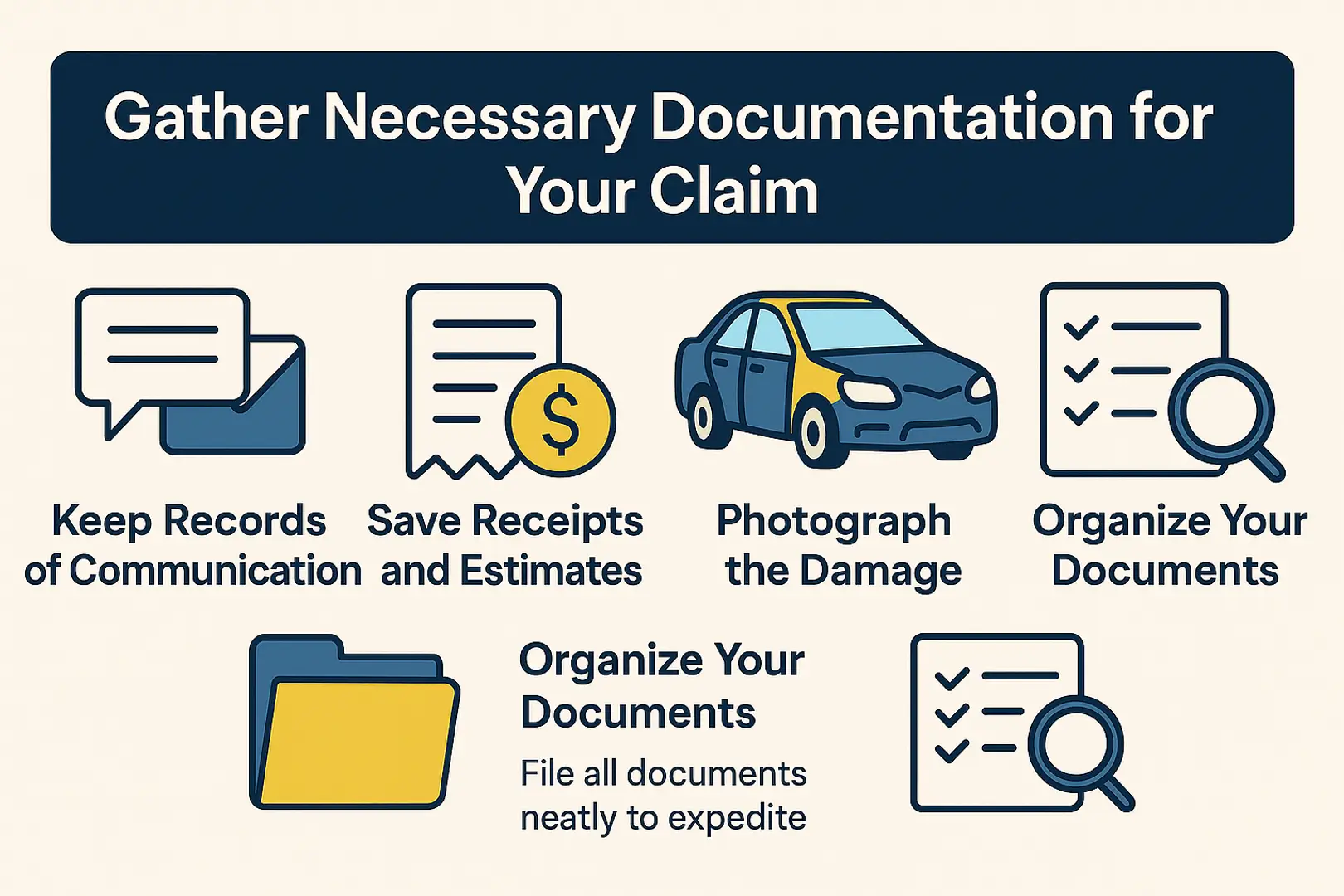

Gathering Necessary Documentation for Your Claim

Accurate documentation plays a pivotal role in ensuring your claim is approved. Keeping detailed records of communication, including emails and phone calls, helps establish a clear timeline and supports your case. Keep records of all interactions with your insurer, including phone calls and emails. Save receipts, repair estimates, and photographs of the damage as part of your evidence.

Having a well-organized file can speed up the process. Missing paperwork or incomplete submissions often lead to delays or denials, so double-check everything before submitting.

Navigating Denied Claims and Appeals

If your claim is denied, don’t lose hope. Review the reasons for the decision and check if it aligns with your policy. Sometimes, claims are denied due to minor errors or missing information. You can appeal a denial by providing additional evidence or clarifications. Stay persistent and communicate professionally with your insurer. Legal or third-party assistance may be helpful if disputes arise.

Conclusion

Getting insurance to cover vehicle repairs requires careful planning and persistence. By understanding your policy and following the outlined steps, you can ensure better outcomes. Stay organized and proactive throughout the process. With the right approach, you’ll be able to handle repairs without unnecessary financial burdens, allowing you to focus on getting your vehicle back in top condition.

Related Posts

© 2025 Invastor. All Rights Reserved

User Comments