Clinical Trials Market Size, Share, Growth, Report 2025 To 2034

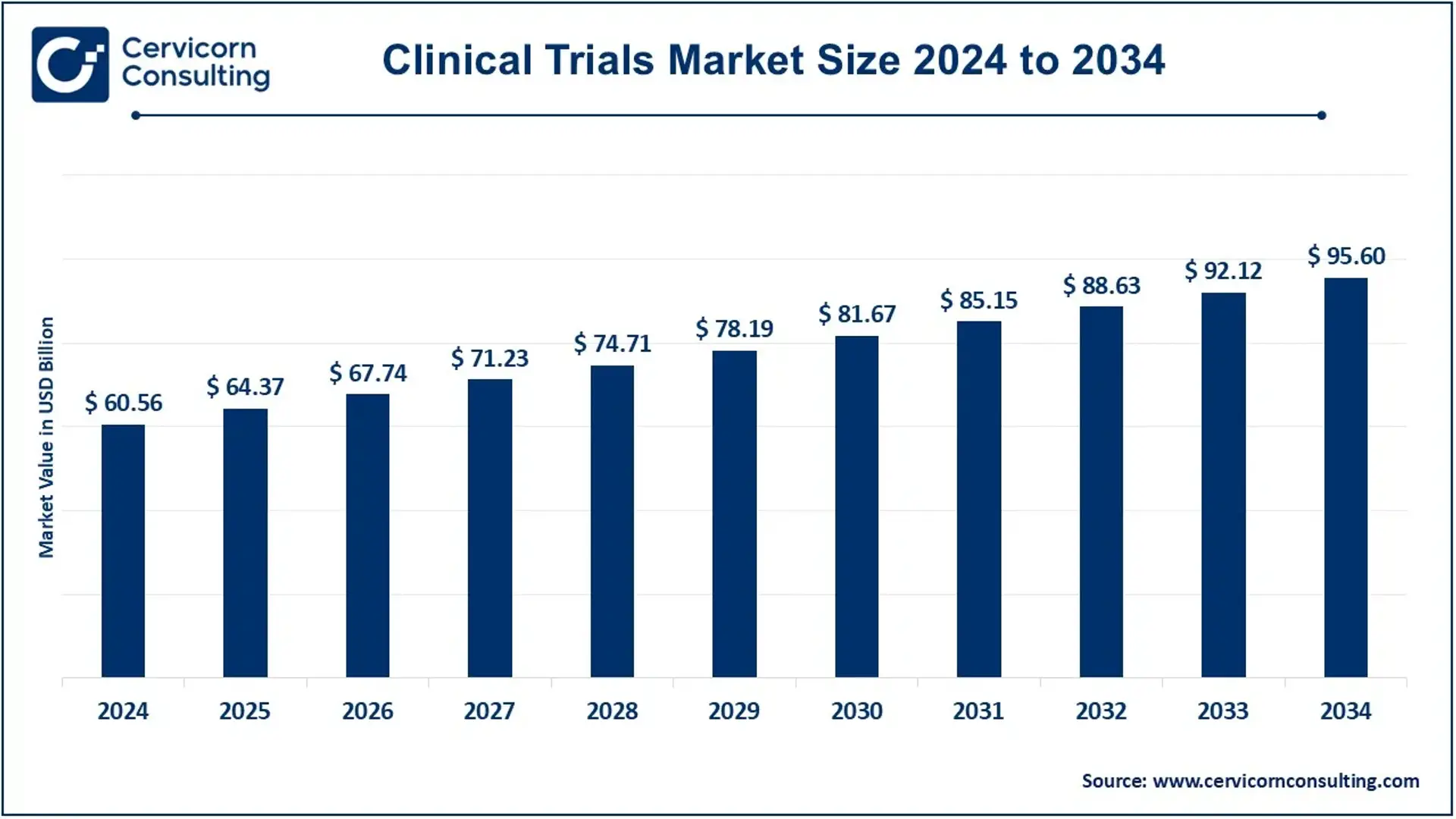

The global clinical trials market size was valued at USD 60.56 billion in 2024 and is expected to be worth around USD 95.60 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.67% over the forecast period 2025 to 2034.

Clinical trials are the backbone of medical innovation. Defined as the rigorous testing of novel therapies, interventions, and drugs—including both traditional pharmaceuticals and cutting-edge biologics—clinical trials serve to establish safety and efficacy prior to market approval. A vibrant Clinical Trials Market encompasses both sponsors (pharma, biotech, academic institutions, government) and execution service providers (Contract Research Organizations, or CROs). Its size and growth mirror global healthcare investment and innovation trends.

Clinical Trials Market Report Highlights

By phase, phase III segment has accounted 48.91% market share in 2024.

By study design, interventional study has captured 76.50% market share in 2024.

By therapeutic area, oncology segment has generated 38.41% market share in 2024.

By region, North America has garnered 53.9% market share in 2024.

Get a Sample PDF of the Report:https://www.cervicornconsulting.com/sample/2308

Current Market Trends

Double-digit growth with projected ~5–9% CAGR

Market size estimated at $64 billion–$86 billion in 2023–2025, with forecast reaching $95–$150 billion by 2030–2034 at ~5–6% CAGR.

North America maintains 44–55% of the market; Asia-Pacific is fastest-growing with ~9–10% CAGR .

Rise of decentralized & hybrid trials

New models leveraging telehealth, at-home monitoring, local labs are gaining momentum, with DCT segment expected to generate $13.3 billion by 2030 .

Adoption of AI, big data, RWE

AI-enabled patient recruitment platforms, predictive modelling, and real-world data analytics are improving recruitment efficiency and optimizing trial design.

Therapeutic focus on oncology, rare diseases, chronic conditions

Oncology leads with ~38% trial share in 2024; rare-disease and orphan drug pipelines add 1.6% CAGR lift globally.

Globalization of trial sites

Trial sites increasingly based in Asia-Pacific (China, India, Japan), Latin America, and MEA to reduce costs and accelerate recruitment.

Market Drivers

Rising prevalence of chronic and rare diseases

Aging populations and NCDs spur demand for new therapeutics.

Expanding pharmaceutical pipelines and R&D investment

Higher spending, patent cliffs, and biotech proliferation drive trial volume.

Outsourcing to CROs

Sponsors seek cost efficiency and operational flexibility, fueling CRO market growth at ~8–11% CAGR.

Technological innovation

Genomics, AI, wearables, in-silico trials (computer simulations) are reshaping trial execution.

Regulatory support for decentralized design

FDA’s final DCT guidance (Sept 2024) and orphan drug incentives accelerate novel trial formats.

Market Restraints

High operational cost & regulatory complexityPhase III trials often exceed $20–50 million on complicated designs, multi-country regulatory harmonization remains burdensome .

Patient recruitment & retention challenges

80% of trials delayed due to participant issues; dropout replacements can cost $19k+ each.

Data privacy & regional infrastructure gaps

GDPR/CCPA hinder e-consent; emerging markets face coordinator shortages and training gaps.

Ethical/regulatory inconsistencies

Concerns over trial quality—especially investigator-initiated trials in China and ethical oversight in India.

Opportunities

Personalized & precision medicine

Biomarker-driven oncology and gene therapies powerful tailwinds; 60% of new drug approvals are personalized.

Emerging markets expansion

Asia-Pacific, Latin America, and MEA offer cost-efficient patient pools—China and India poised to outpace global share.

Hybrid trial models

Flexibility drives participant satisfaction; sponsor adoption removes logistical bottlenecks.

AI-driven efficiency

Enhanced trial design, lower screen failure rates, optimized operations .

Digital twin & in‑silico trials

Simulations reduce reliance on human subjects, accelerate hypothesis testing.

Regulatory incentives

Orphan drug status, rare disease grants, tax credits (e.g., Australia) support novel trial funding.

Clinical Trials Market Segmentation

By Phase

Phase I

Phase II

Phase III

Phase IV

By Indication

Autoimmune/Inflammation

Pain Management

Oncology

Cns Condition

Diabetes

Obesity

Cardiovascular

Others

By Therapeutic Area

Oncology

Infectious Diseases

Neurology

Metabolic Disorders

Immunology

Cardiology

Genetic Diseases

Women’s Health

Others

By Design

Interventional

Treatment Studies

Observational Studies

Expanded Access

Others

By End-Users

Hospitals

Laboratories

Clinics

Others

Request For Customization:https://www.cervicornconsulting.com/customization/2308

Regional Market Insights

North America

Market value: $26–27 billion (2024); ~54% global share.

Strengths: Top-tier labs, strong R&D budgets (Pfizer >$10 B, Novartis $10 B+), comprehensive regulatory support, high use of rare disease trials.

Europe

Share: ~12–27% depending on source; recent drop from 22% to 12% of global trials due to red tape .

Key hubs: Germany (top R&D spend), UK & France strong in oncology and rare-disease studies .

Barrier: Fragmented regulation despite EMA portal reforms (2022) .

Asia-Pacific

Growth: Highest CAGR ~9–10%; China now top global for trial registrations .

Drivers: Low costs, large naïve patient pools, faster trials and looser regulations .

India opportunity: Currently ~8% share—could exceed $2 billion by 2030 with regulatory improvements .

Japan/Australia: High-quality trials in oncology, regenerative medicine; Australia offers tax incentives .

Latin America & Middle East/Africa

Growth: Latin America at ~6–6.5% CAGR; MEA growing from small base .

Highlights: Brazil leads in LATAM; Saudi Arabia, UAE, and South Africa gaining regional traction .

Clinical Trials Market Top Companies

IQVIA Holdings Inc.

PPD, Inc.

ICON plc

Parexel International Corporation

Covance Inc. (LabCorp Drug Development)

Syneos Health, Inc.

Medpace Holdings, Inc.

PRA Health Sciences, Inc.

Charles River Laboratories International, Inc.

WuXi AppTec Inc.

Pharmaceutical Product Development, LLC (PPD)

Labcorp Drug Development (formerly Covance)

Worldwide Clinical Trials

In the clinical trials market, new players adopting innovation include Veristat, a CRO specializing in biotech and pharmaceutical trials with a focus on rare diseases and oncology. Additionally, Clincierge offers patient recruitment solutions through technology-driven approaches. Key players dominating the market include IQVIA, known for its comprehensive data analytics and clinical trial management solutions. PPD, with its global reach and broad therapeutic expertise, and ICON plc, renowned for its strategic consulting and operational excellence, are also significant players. These leaders maintain dominance through extensive service offerings, global presence, and strong client relationships, ensuring robust growth and market leadership.

Future Market Growth Potential

Market size forecasts range between $95–150 billion by early 2030s .

Growth accelerants include:

Hybrid/digital trial models (+1.9% CAGR impact) ;

Orphan/rare-disease pipeline growth (+1.6%)

Conclusion

The clinical trials market stands at a transformative juncture, blending advanced technology, strategic expansion, and global collaboration. While challenges like cost, recruitment, and regulatory complexity persist, the trajectory remains strongly upward. Emerging markets—especially China and India—alongside precision and patient-centric models, herald a future where trials are faster, smarter, and more inclusive. Stakeholders who adapt to digital innovation and geospatial expansion will thrive in the evolving landscape.

Purchase the Report: (Available for 3800 USD for a single-region license)-https://www.cervicornconsulting.com/buy-now/2308

About Us: Cervicorn Consulting specializes in providing expert analysis and accurate market intelligence, helping companies of all sizes make well-informed decisions.

Contact Us:

Phone: +91 7499931916

Related Posts

© 2025 Invastor. All Rights Reserved

User Comments