Top 5 Mistakes Beginners Make in Paper Trading

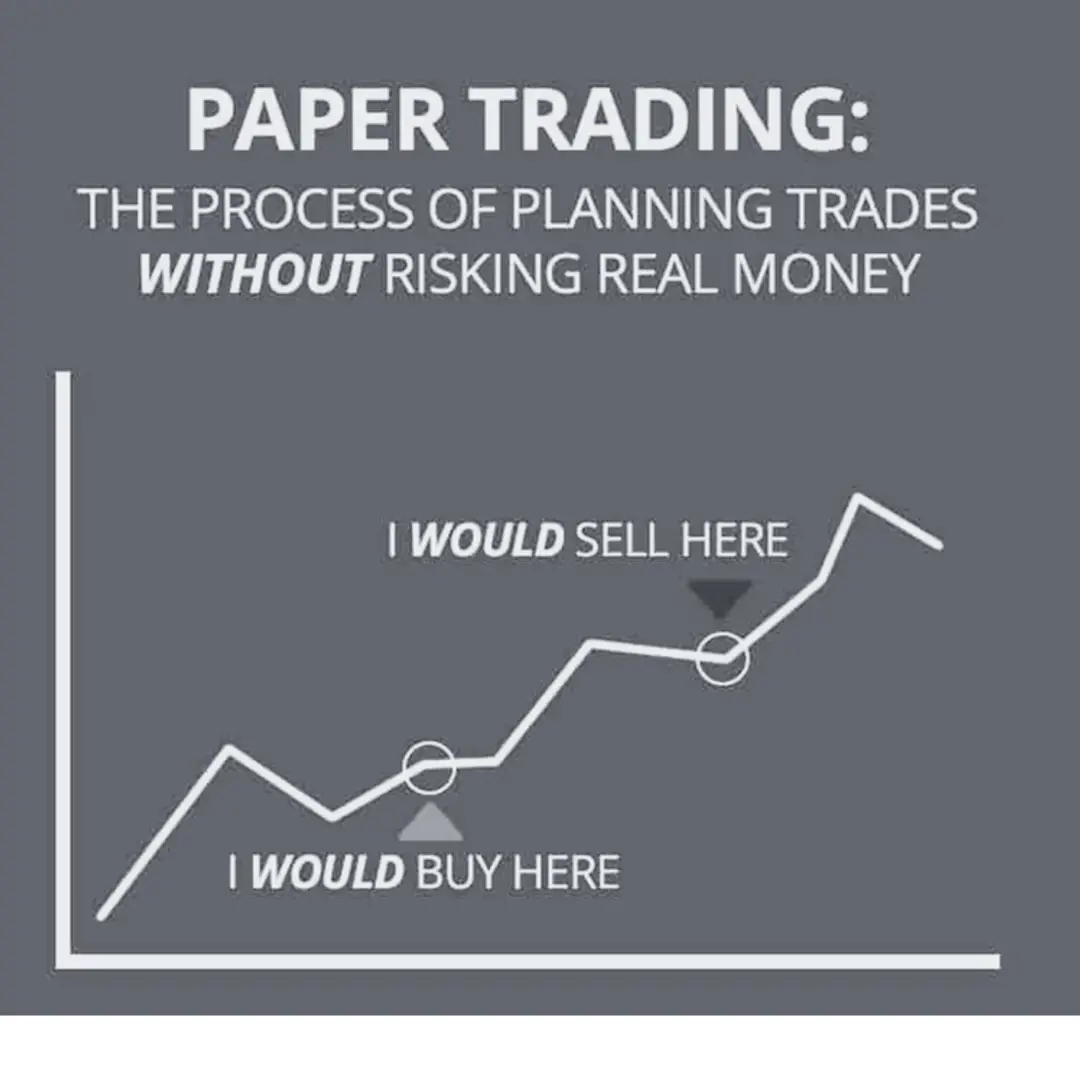

Traders test trading strategies without exposure to real money in an anonymous environment provided by paper trading. Novice trainees who intend to know the market mechanics before going live benefit from it. While a risk-free zone for learning, paper trading traps many learners who may become inactive in their progress. Here are five common mistakes that new traders make while engaging in paper trading.

- Not Taking Paper Trading Seriously

Many beginners approach paper trading with laxity, thinking that it is less serious than real trading, which is among the common sins of paper trading. Thus, they might use imaginary position sizes and trade impulsively, with no real money at stake. This gives rise to habits that are difficult to kick before real money comes into the picture.

Traders must treat paper trading as live trading in regard to discipline, homework, and emotional control if they want to deliver benefits. Every trade they make should follow a plan that includes entry, exit, and risk management criteria. The goal of paper trading is not just to make pretend profits but to develop consistent behaviors that translate well in real market conditions.

- Ignoring Transaction Costs and Slippage

Paper trading platforms do not accurately calculate commissions and slippage. Newbies usually do not account for such costs, thus creating huge expectations regarding their strategy performance. In real markets, transaction costs may dramatically affect profit results, particularly in short-term strategies or high-frequency trading strategies.

To make their paper trading rounds as realistic as possible, traders should manually adjust them to include hypothetical transaction fees and, if possible, slippage. Some platforms provide options to simulate these features, which can give a much clearer picture of how a strategy may perform in real conditions.

- Overtrading and Lack of Patience

Few paper traders resist the temptation to trade frequently because there are no financial ramifications for losses. Beginners will sometimes trade dozens of times daily without much analysis, leading to a false impression of what trading in real markets requires. This habit could lead to eventual losses as soon-old habits die hard once they transition to live trading.

Traders should practice paper trading to develop that patience and selectiveness, concentrating on quality rather than quantity. Keeping track and journaling trades can determine whether they resulted from a good setup or just an itch for staying active in the market.

- Not Tracking Performance Properly

People will hardly maintain a trading journal or a detailed log while doing paper trading. Thus, when it comes to analyzing different strategies and understanding which works or which mistakes are repeated or where improvements may be needed, they find it difficult. Poor documentation weakens self-assessment and the learning process.

Paper trading involves maintaining an entry and exit record, reasons for entering the trade, emotions experienced during the trade, and the outcome. This data can show patterns in behavior and performance. Traders should view paper trading as more than just executing; they should focus on developing analytic skills.

- Overstating Paper Trade Results

One of the largest psychological traps of paper trading is the erroneous assumption that success in a simulated environment will automatically carry over to the real world of trading, where they miss the emotional weight of risking real capital. Fear, greed, and anxiety often play a major role in decision-making in live trading.

Beginners rely on paper trading results alone to gauge their readiness for the real markets and can fall into overestimation. They must realize that paper trading is merely a tool for preparing and, more importantly, not a foolproof way of guaranteeing future results.

Conclusion

Time spent in paper trading is of real significance in the process of learning for any newcomer to the trading sphere. Its efficacy shall be judged based on how seriously and accurately traders adhere to it. Avoiding casualness, recognizing hidden costs, being patient, recording everything properly, and understanding the limitations of simulated success will all strengthen a beginner when it comes to the process of live trading.

Related Posts

© 2025 Invastor. All Rights Reserved

User Comments